Paycheck Planner: How to Plan Your Expenses Around Your Paychecks

Feb 26, 2025

When you peel back the layers of personal finance, it’s simpler than it seems. At its core, managing your money comes down to four categories: 1) income, 2) essential expenses, 3) discretionary spending, and 4) saving for the future. The key is managing these categories effectively.

Money flows in and out of your accounts at different times. Maybe you get paid bi-weekly, but your bills are due at varying times throughout the month. Some may even be due quarterly or semi-annually. This may sound complicated, but don’t worry—I’ll walk you through how I manage my paychecks and maybe it’ll work for you too!

Step #1: Develop Taproot Budgeting

The first thing I did was develop Taproot Budgeting. I tried A LOT of budgeting apps and it always felt like I was trying to fit a square peg in a round hole. Well, that is no more and thankfully you can skip this step. Even if you don’t use Taproot, you can still apply the principles.

You can try Taproot for free and see how easy it is, or simply follow along and maybe pick up useful tips.

Step #2: Income

The foundation of splitting up your paycheck starts with…… (drum roll)… your paycheck. The first thing I did is enter my wife’s and my incomes. The key information here is:

Amount: How much do you typically receive? If the amount varies, you can enter an estimate for Taproot to use and then update as your payday comes closer.

Frequency: How often are you paid? Select your next payday and input your pay schedule (i.e., weekly, bi-weekly, monthly, etc.).

That’s it! You’re one step closer to gaining control over your paychecks.

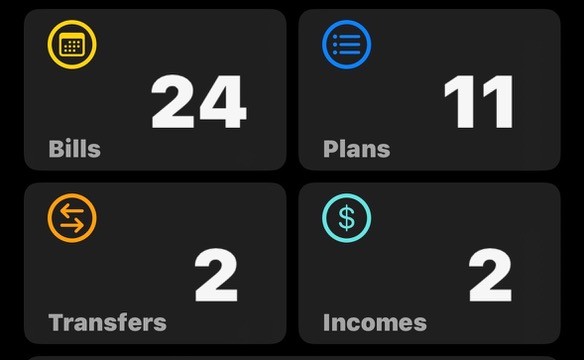

Step #3: Bills

Tracking your bills might not be the most exciting part, but it’s crucial. The main thing is just making sure you capture all your bills. Here are some examples of things I forgot to enter into Taproot:

Costco membership renewing in November

Auto registration due in February

Pet Insurance due in July

Taproot’s onboarding gives you a huge jumpstart on this! It’ll ask you some simple questions and start automatically building your budget. For the most part, you just need to update the amounts and frequencies. After onboarding, you can add any other bills you have.

Step #4: Spending Plans

Next, add your “Plans”—expenses that happen over time, like groceries or gas. These aren’t due on a specific date but instead accumulate over a period (e.g., monthly). You’ll track how much you plan to spend, and as you spend, the amounts in these plans will adjust accordingly. Plans can be set for different time periods: monthly, weekly, or even daily!

Step #5: Transfers

If you regularly transfer money to other accounts (ex., for a travel fund), make sure you account for these as well. For example, every month we transfer money into our “Travel Fund.” I entered this as a Transfer in Taproot so I could make sure I had enough money to transfer by the date I had scheduled this transfer to take place.

Step #6: Account for Credit Card Spending

We put most expenses on a credit card and pay off the statement each month. This helps us earn rewards and avoid interest. This obviously isn’t for everyone as credit cards have a way of getting away from folks. For more information on how we do this, check out Hacking your Budget With a Credit Card.

If you use a similar strategy, mark those bills and plans that are paid via credit card in Taproot. This way we know what bills and spending will have an immediate impact on our available money and we avoid double-counting expenses when analyzing our spending.

In Taproot, this is as easy as flipping a toggle when adding or editing bills and plans.

Step #7: Monitor Your Safe Balance

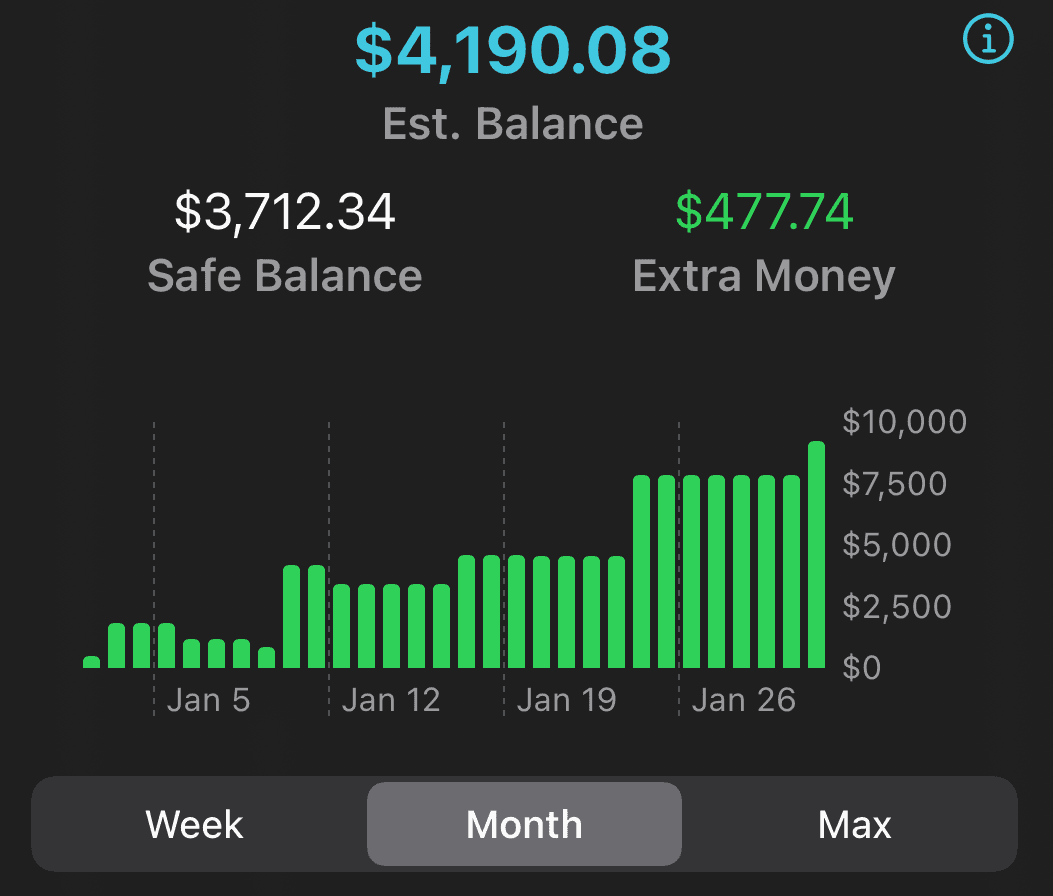

By now, you’ve entered all your income, bills, plans, and transfers. Now it’s just math. Here’s the trick that I found most useful. It’s not necessarily how to split up your paychecks to cover each expense (ex. setting $150 for each paycheck to cover rent). You can certainly do that (see YNAB for envelop budgeting), but I personally found it too cumbersome for my liking.

Instead, I focus on the reason why I wanted to split my paychecks. That is to answer the question: how much money do I need to have in my account today to make sure I have enough money for what’s coming out of my account later? I call this my Safe Balance. As long as I have this balance in my account, I know I’m good. Anything over that amount, I call Extra Money. With this money, I am free to save, invest, or go nuts with.

To calculate Extra Money, add up your current account balance along with any future bills, plans, and transfers (while considering credit card payments). Track your projected balance daily to make sure it stays positive.

I like to forecast 60 days ahead so I can identify which day will have the least “Extra Money.” That’s the most I can safely save or invest today while still covering future expenses.

Okay, that got a bit more complex than I expected. This is another reason that I developed Taproot. It does all that math for you so you don’t have to stress about it.

Side note - this can be seen as cashflow budgeting. If you are interested in learning more, check Cashflow Budgeting: A Simple, Flexible Approach to Managing Your Money.

Step #8: Use Your Extra Money

This is the fun part. You know you have enough money in your account to cover your upcoming expenses and see that you have Extra Money. It’s up to you what to do with it. Maybe you save it. Maybe you invest it. Maybe you treat yourself. Whatever floats your boat - you already put in the work. Just make sure to track whatever you do so your future calculations stay accurate!

Wrapping Up

I hope you found these tips helpful in planning your paychecks. I highly recommend Taproot as it simplifies the budgeting process and helps you stay ahead without feeling overwhelmed by rigid methods.

You can try Taproot today with a free trial and see how easy it is to take control of your money.