Cashflow Budgeting: A Simple, Flexible Approach to Managing Your Money

Feb 21, 2025

What is Cashflow Budgeting?

Budgeting is often seen as a rigid, time-consuming system where you track every penny, and yeah, that can be pretty stressful. But what if budgeting didn’t have to feel like this heavy burden you had to pull out any time you were thinking of buying something?

That’s where cashflow budgeting comes in. Cashflow budgeting is a method that’s all about making sure you have enough money to cover your upcoming expenses while giving you the freedom to use the remainder for saving, investing, or just living your best life.

Unlike traditional budgeting (ex. zero-based, envelope, etc.) which can often feel like you’re living in a spreadsheet nightmare, cashflow budgeting is focused on one simple thing: making sure you have enough for what’s coming up. Once those expenses are covered, you only have one decision: what to do with the money left over.

Ready to see how this can work for you? Let's do it.

Getting Started

Cashflow budgeting may sound complicated, but chances are, you're already doing it—at least in your head! For example, you might think something like: “I’ve got $800 in my checking account, I get paid on Friday, and I need to set aside $750 for rent and $250 for my car payment.’”

This is basically forecasting your cashflow! As things get more complicated with varying pay cycles, subscriptions, and random expenses, cashflow budgeting helps you manage it all without feeling stressed.

How Does It Work?

Cashflow budgeting is pretty straightforward - here is a quick breakdown.

Track Your Income – How much and when are you paid?

Identify Your Fixed Expenses – Rent, car payments, utilities, Costco memberships, phone bills - anything with a set due date.

Plan for Variable Expenses – Groceries, eating out, gas, or money just for fun.

Add a Buffer - Always keep a little extra for unexpected costs.

Save and Invest the Rest – Once your essentials are covered, the fun really starts. Use this extra money for savings, investments, or whatever you want. I don’t know - it’s your money. Make it work for you!

The Benefits of Cashflow Budgeting

Simpler - No more spending time planning next month's budget or wondering what expenses might come up.

Stress-Free Flexibility – You’ll have the confidence that your expenses are covered and the flexibility to adjust things as needed.

Clearer Financial Picture – You’ll know exactly how much money you have to play with after you’ve covered your expenses. No more second-guessing!

Tips for Success

Maintain Your Budget - Add new expenses or adjust amounts when necessary. Life changes, your budget should keep up!

Track Your Spending in Real-Time - The sooner you input a purchase, the better. Most of the time, I’m entering things right after I swipe my card. Plus, it helps you stay on top of those sneaky impulse buys!

Credit Cards & Cashflow - If you’re using a credit card, make sure to account for it in your budget. Credit card charges don’t immediately impact your cash, but they’ll affect your cashflow when your statement comes due. Be sure to track it, or things can get out of hand! Interested in more info about credit cards and budgets? Check out Hacking Your Budget With a Credit Card.

How Taproot Budgeting Makes Cashflow Budgeting Easy

So, now that you know the basics of cashflow budgeting, how can you make this process even easier? The answer: Taproot Budgeting.

I developed Taproot Budgeting because I was tired of trying to fit this mindset into how a lot of the traditional budgeting apps worked. Well, no more forcing a square peg into a round hole! After years of struggling, I built Taproot to fit the way we naturally think about money. It’s a budgeting app made for real life—and I’m pretty sure it can work wonders for you too!

That being said, maybe this type of budgeting doesn’t feel right for you. In that case, I’d recommend checking out Every Dollar or YNAB. Every Dollar is built around zero-based budgeting, while YNAB is an envelope budgeting system. I used Every Dollar’s free version for years and it gets the job done.

Still here? Well, let me tell you a bit about Taproot.

What is Taproot?

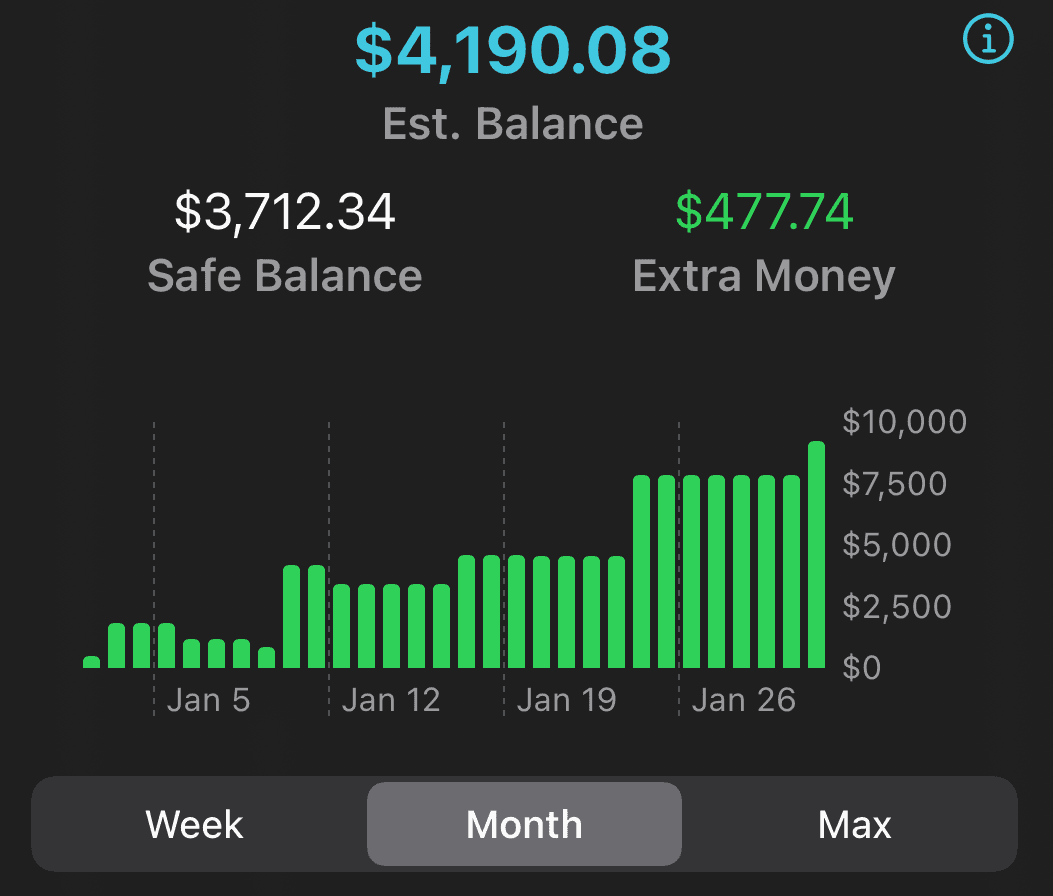

Taproot is a different kind of budgeting app on iOS that was designed to simplify budgeting. It helps you track income, expenses, and—most importantly—understand your cashflow so you’re always prepared for what’s coming next. No more guessing how much you have left over or trying to juggle multiple spreadsheets.

How Taproot Helps You with Cashflow Budgeting

It Just Flows - Taproot looks ahead 60 days and identifies what income and expenses you have coming up. Simply check them off as they happen.

Forecast Upcoming Costs – It helps you forecast upcoming expenses, ensuring you always have enough set aside.

Visual Cashflow Overview – Taproot gives you a clear visual of your available funds after covering necessary expenses, making it easier to decide how to allocate your remaining money.

Taproot helps you focus on the big picture: making sure you have enough to cover your expenses.

Conclusion

Cashflow budgeting isn’t about restricting yourself. It’s about making sure your expenses are covered and giving you the freedom to use the rest for your financial goals—whether that’s saving for the future, investing, or simply enjoying life without constantly worrying about money.

Taproot takes the stress out of budgeting by simplifying the process and helping you stay ahead. It’s the flexible solution you need to take control of your finances without feeling overwhelmed by rigid budgeting methods.

Ready to start your cashflow budgeting journey? Try Taproot today with a free trial and see how easy it is to take control of your money. You’ve got this - let’s make budgeting a breeze!